In our last post, Why Lenders Need a No-Code AI Workflow Builder, Today, we shared why the future of lending depends on empowering processors and underwriters to build automation themselves.

Margins are shrinking. Turn times are critical. Manual tasks are burning hours your team doesn’t have. This is where AI mortgage automation changes everything: it lets your team work faster, with fewer errors, and at lower cost.

And unlike black-box automation tools, Loyola AI gives you something no one else does: true control.

Beyond Black-Box Tools

Many tools claim to offer automation, but most operate as closed systems. They run a fixed process you can’t change. Maybe you can toggle a few settings—but you can’t adapt them to your policies, your workflows, or your people.

That doesn’t work in lending.

Every lender has unique guidelines. And most workflows live inside the heads of your processors and underwriters—domain experts who are rarely empowered to build.

Loyola AI changes that.

Our platform gives processors and underwriters a way to turn the workflows in their minds into reality, visually and instantly, without needing an engineer.

This is not just AI mortgage software. This is how you build your own automation.

Inside the Workflow Builder

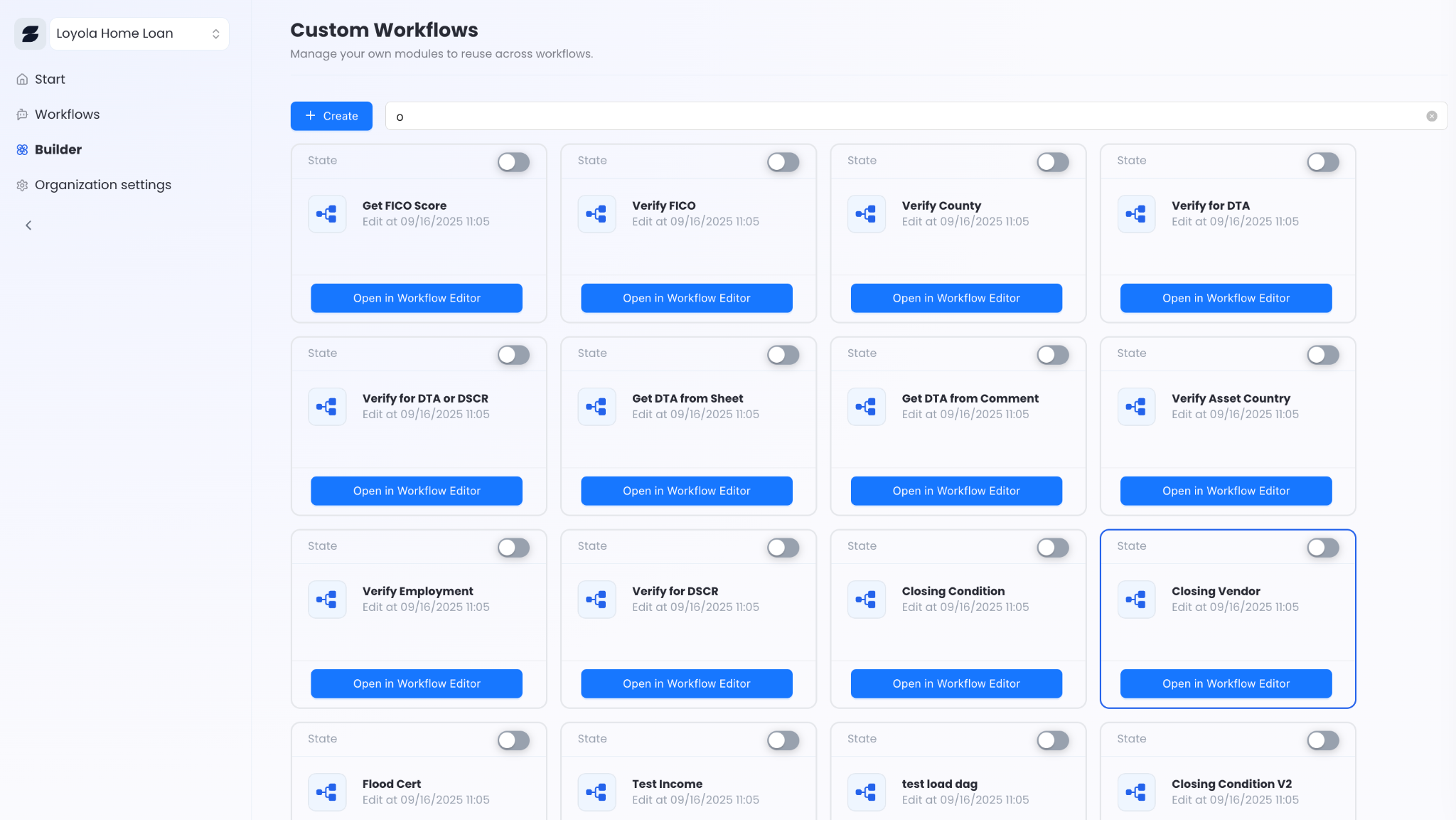

When you open the platform, you’ll land on the Workflow Builder tab.

- On the left is a library of pre-built workflows, ready to run

- On the right, you can create new workflows from scratch

- Each workflow can automate anything from data entry to Encompass 1003 population

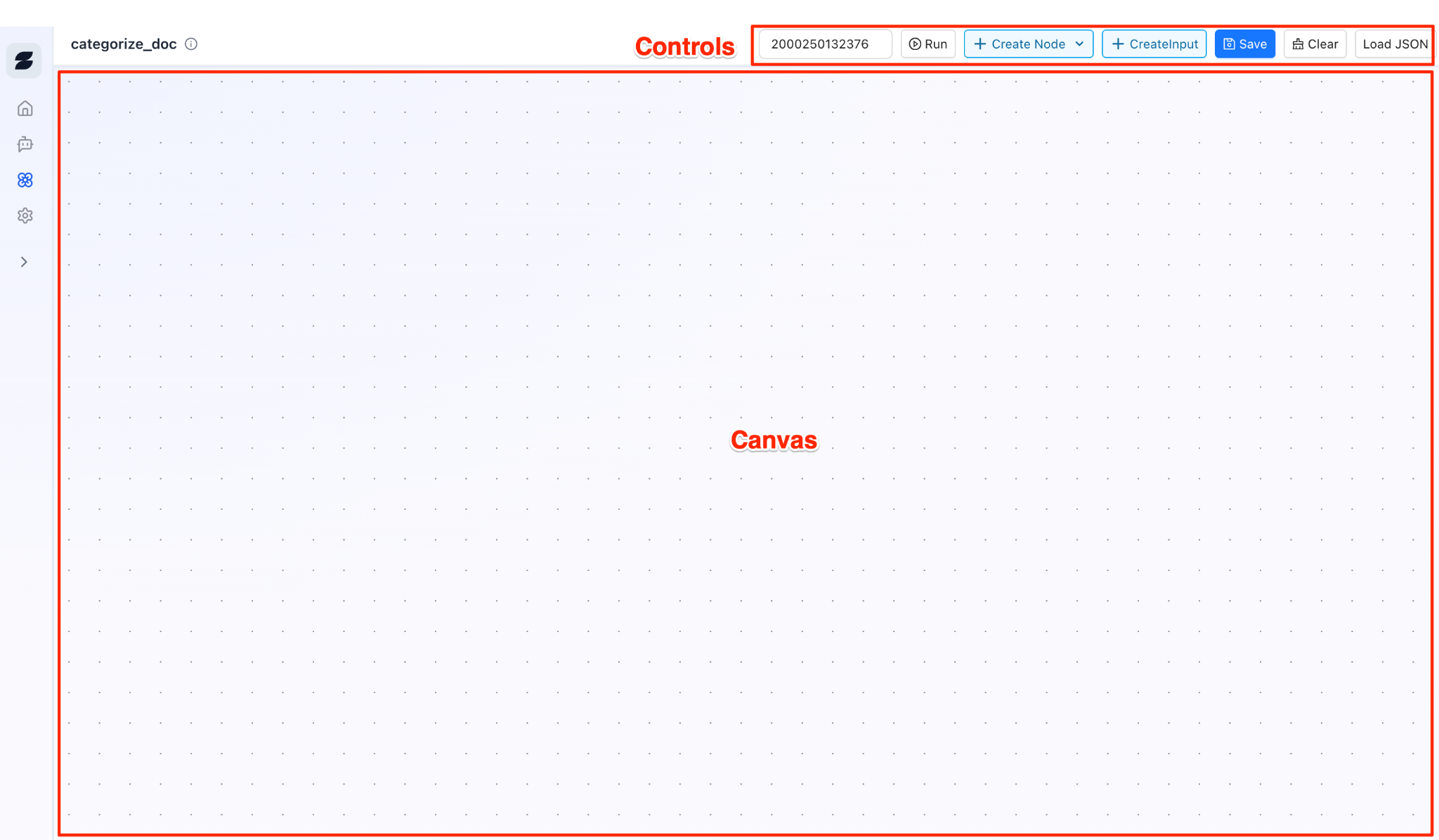

Click “New Workflow” and you’ll see a blank canvas—your automation playground.

- The center is your canvas for dragging and connecting nodes

- Across the top are controls to add nodes, save, run, and view results

This is where processors and underwriters can finally map out the workflows they’ve always envisioned.

Your First Node: Document Categorization

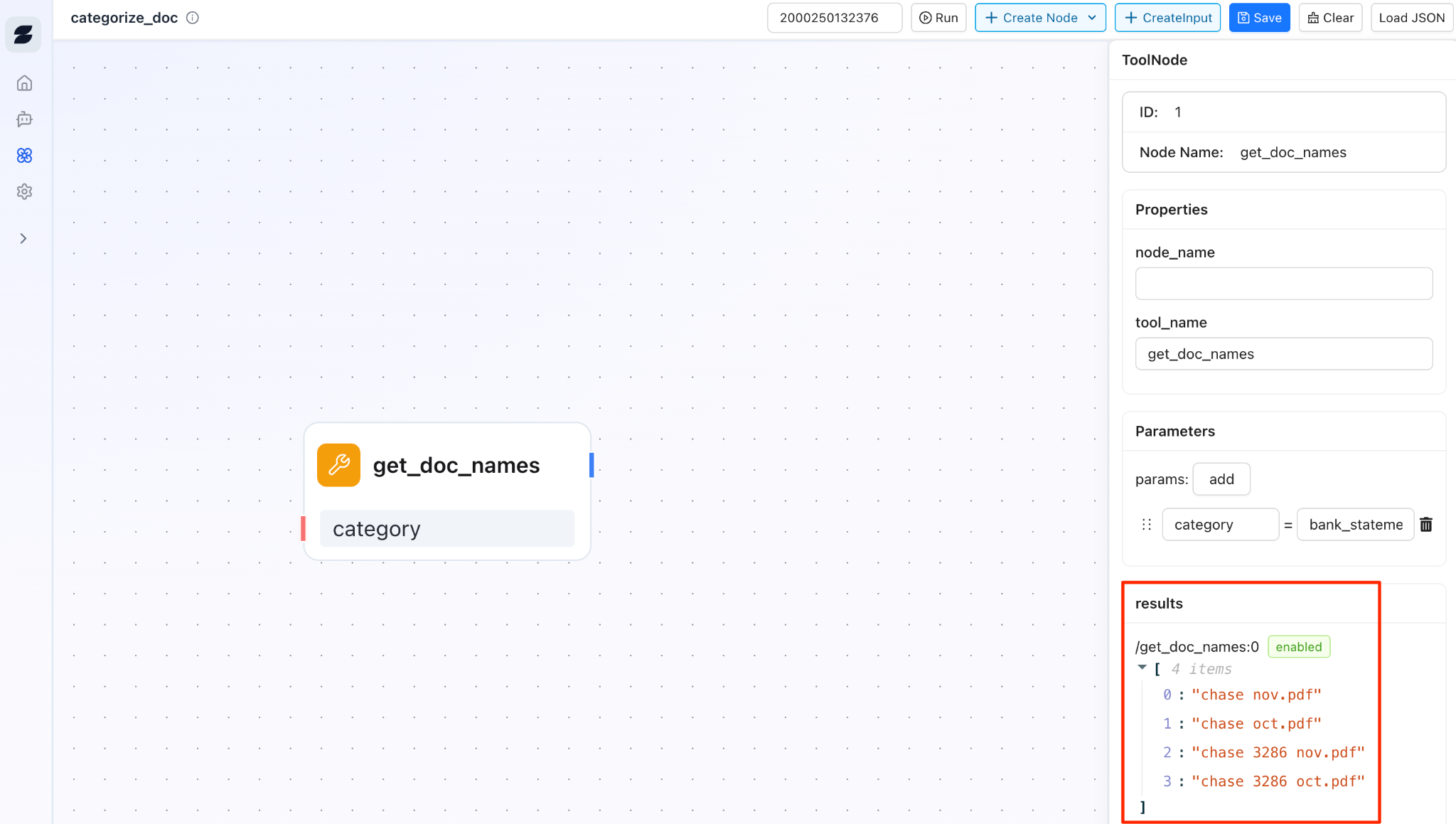

Let’s start with a simple example that shows the platform’s power: document categorization.

We provide a built-in tool called get_doc_names. It takes a category (like "bank_statement") and instantly returns every matching document in the loan file.

We currently support 50+ common mortgage document types, and you can add your own custom categories with just a few clicks.

This makes it easy to:

- Automatically label and organize documents into folders

- Prepare documents for further steps like data extraction and validation

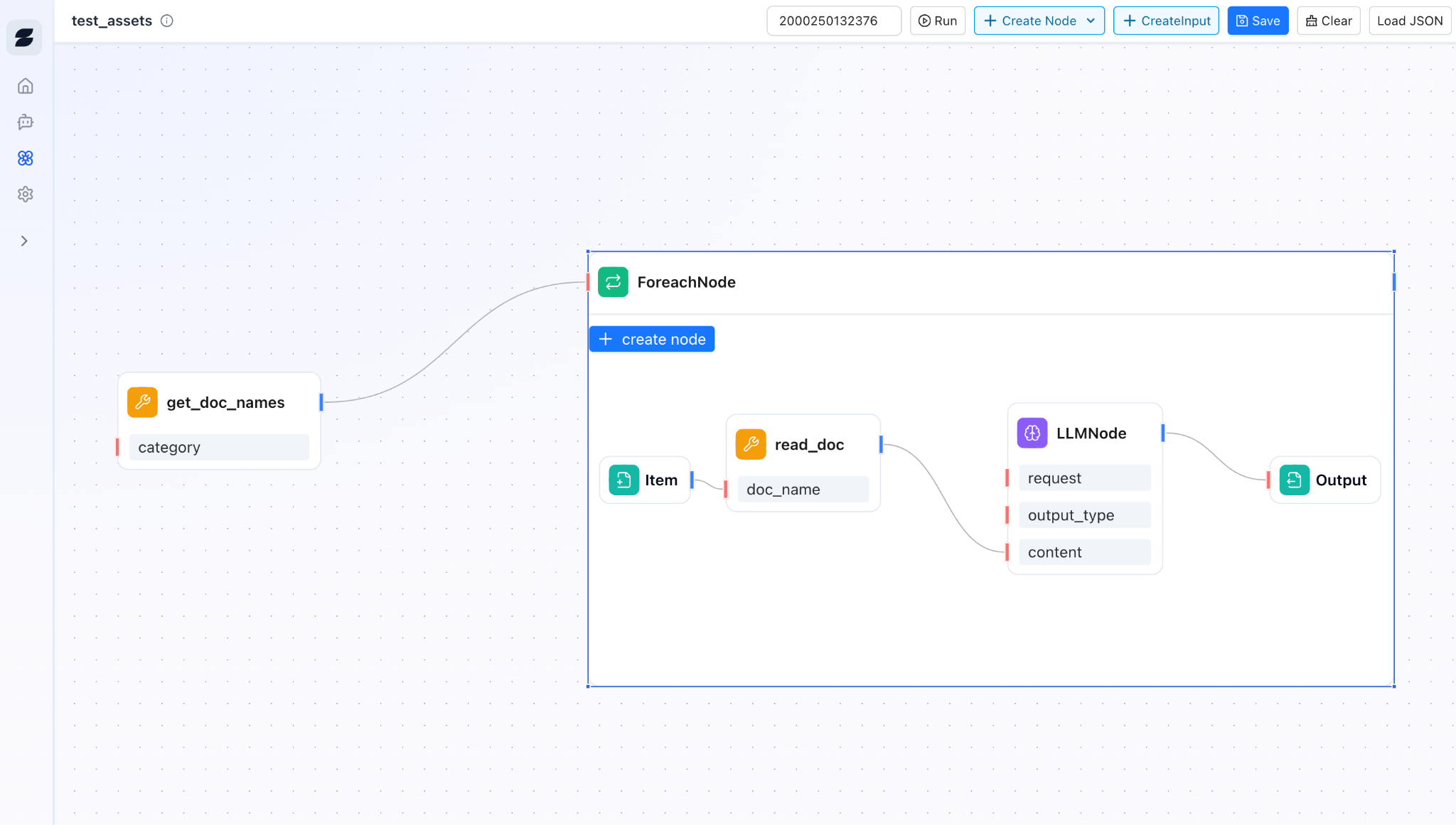

For example, you could build a workflow that parses bank statements to extract balances and write them into the borrower’s Encompass 1003—something we’ll explore in detail in an upcoming post.

Start Building Today

This is what AI mortgage should be: transparent, customizable, and built for the people who know the workflows best.

Instead of buying a black box, you can build your own future.

If you’re ready to empower your team with no-code AI mortgage automation, we’d love to show you what’s possible.

👉 Book a demo today and start building your first workflow.