This guide explains how mortgage lenders can eliminate manual bank statement entry by using an AI agent to automatically extract asset data and populate the 1003 (URLA) form in Encompass.

Challenges

- ⏱ Time-Consuming Manual Entry

Entering 5+ bank accounts per borrower typically takes 10–15 minutes per loan. For lenders processing hundreds or thousands of loans monthly, this adds up to dozens of hours of manual work.

- ❌ Error-Prone Workflows

Manual entry is highly susceptible to typos, formatting inconsistencies, and missed fields—leading to downstream errors, loan delays, and costly post-closing corrections.

The Solution: AI Agents Built for Encompass

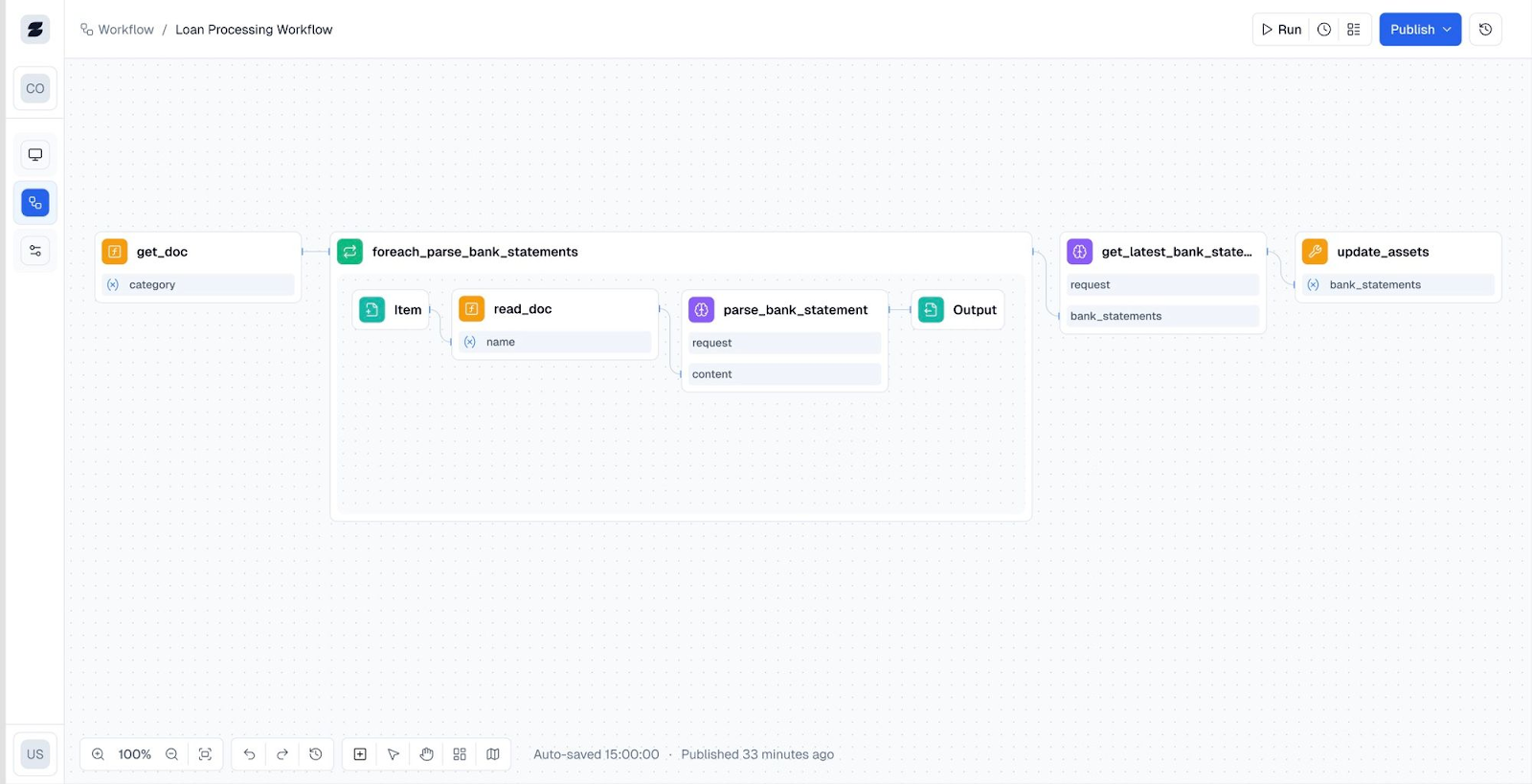

Loyola AI has developed a no-code AI agent purpose-built to automate the entire asset entry workflow—eliminating manual data input while ensuring accuracy, auditability, and scalability.

Step 1: Identify the Manual Workflow

Before automating, clearly define the tasks involved:

- MLOs and processors search through borrower-uploaded documents to locate the most recent bank statements for each account.

- They manually transcribe key data—bank name, account number, balances—into the asset section of the 1003 form in Encompass.

- Statements are typically in PDF format and vary in layout by institution.

Step 2: Collect Bank Statement Documents

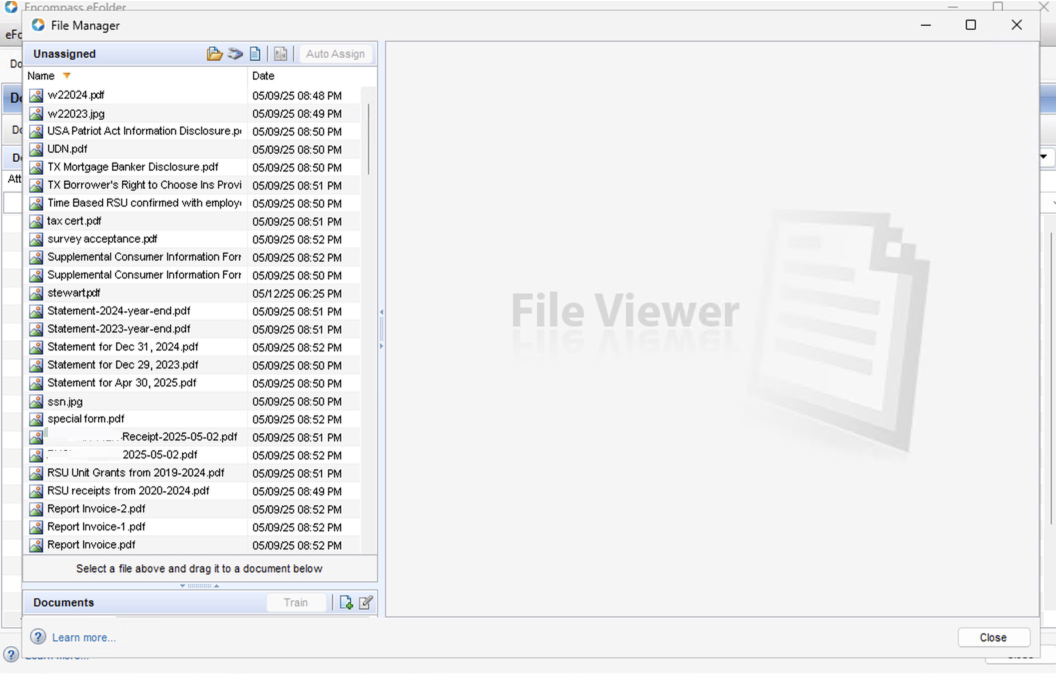

During document collection:

- Ensure all borrower-uploaded documents are centralized and accessible to the AI agent.

- Focus on PDFs, scanned images, or portal downloads that include asset data.

Step 3: The AI agent Selects the Right Documents

Using AI-powered classification:

- Automatically detect which uploaded documents are bank statements—even if unlabeled or combined with other documents.

- Distinguish between checking, savings, and investment account statements.

Step 4: Retain the Most Recent Statements

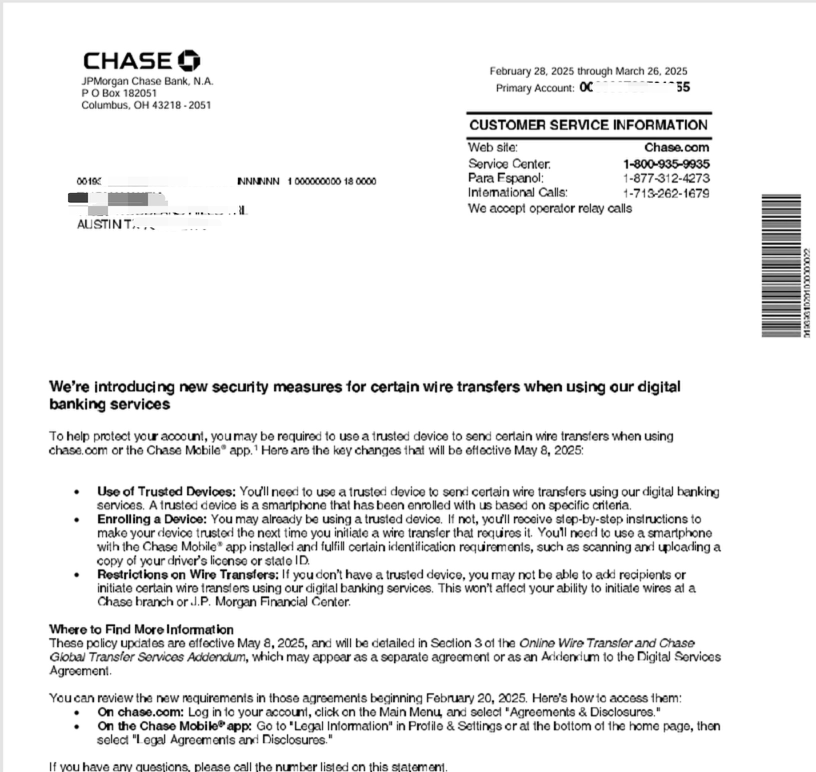

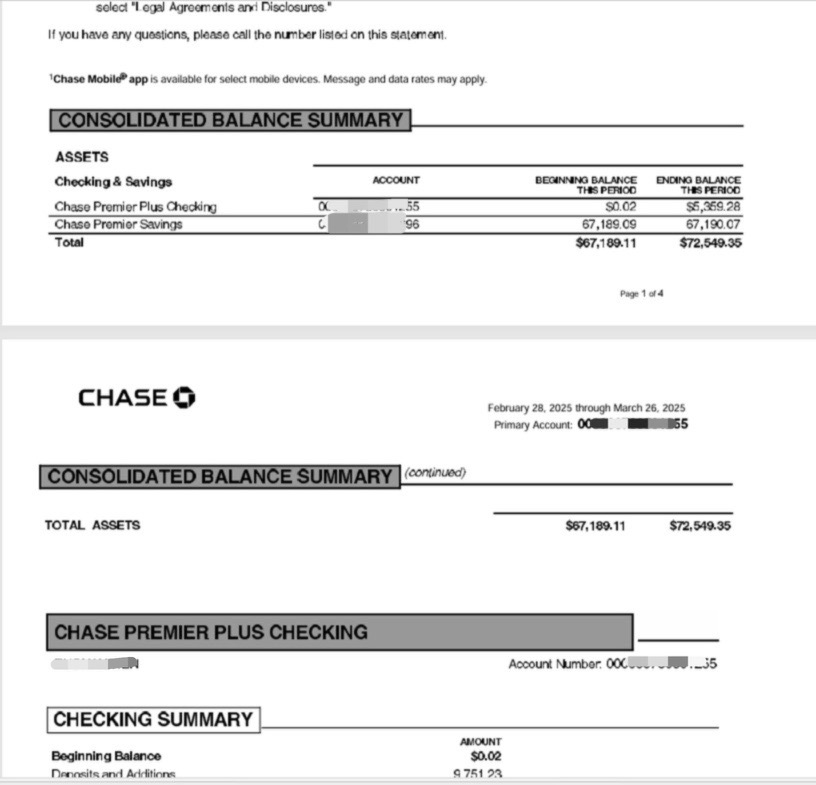

For each account:

- Loyola AI filters and selects the latest available statement based on dates.

- Duplicates, outdated versions, and irrelevant documents are excluded to streamline data extraction.

Step 5: Extract Key Data from PDFs

AI-based OCR and document understanding extract essential fields, including:

- Bank Name

- Account Holder Name

- Full or Partial Account Number

- Statement Start and End Dates

- Ending Balance

These values are normalized and structured for Encompass input.

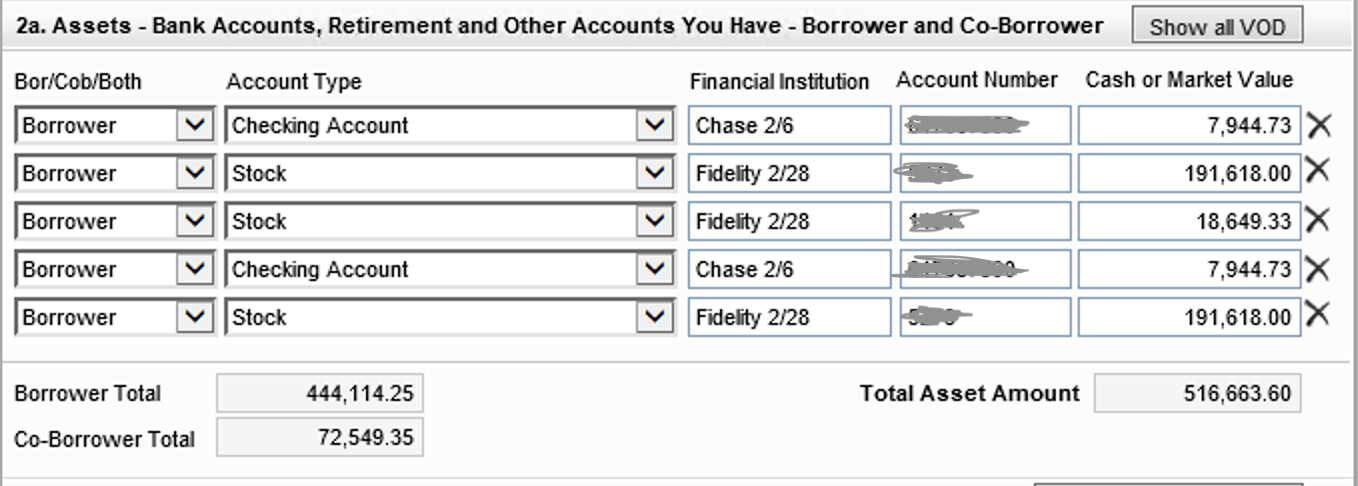

Step 6: Populate the 1003 (URLA) Form

- The AI agent pushes the extracted data into the asset section of the borrower’s 1003 form within Encompass.

- Each bank account is mapped to the correct section, whether checking, savings, or retirement.

- Entire process is automated—no human review is required unless a flag is triggered.

Step 7: Optional – Add Custom Business Logic

Enhance automation with lender-specific rules:

- Flag large deposits for sourcing verification.

- Validate reserve requirements against program thresholds.

- Trigger alerts for missing or unreadable statements, mismatched names, or unsupported file types.

These logic layers are fully configurable and adapt to your underwriting workflow.

Results You Can Expect

✅ Save 10–15 minutes per loan

✅ Eliminate errors and rework

✅ Ensure consistency across teams